What could VAT changes mean for your business?

14/11/2017

The Office of Tax Simplification (OTS) has published a report into VAT simplification following feedback from trade associations, businesses, professional bodies and individuals.

The report contains 23 recommendations for simplifying the tax including changing the VAT registration threshold, administrative changes and reducing complexity surrounding the types of supply subject to VAT relief.

Here we look at what changes to VAT could mean for businesses and the wider economy.

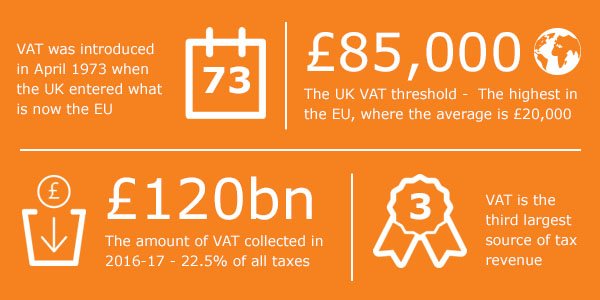

Key VAT stats

Why does VAT need changing?

After over 40 years, the tax is showing its age. What was meant to be a simple tax has become highly complex and it has not kept pace with changes in society.

Angela Knight CBE, Chair of the OTS board, said: “This report presents an opportunity to start addressing the many anomalies of VAT. The tax is awash with layers of complexity reflecting both its evolution over the last 45 years and aspects of the Purchase Tax that VAT replaced. For small businesses, this report will propose ways of simplifying many irritating administrative technicalities and kick off a debate about the registration threshold.”

There are many quirks in the current VAT system. For example:

- The Jaffa Cake debate: Is it a cake (zero-rated for VAT) or a chocolate-covered biscuit (taxable)?

- When using a fast food outlet, do you ‘eat in‘ (taxable) or ‘out’ (when no VAT is due for exactly the same food)?

- A gingerbread man with chocolate-covered trousers is subject to VAT, but not if it has chocolate eyes.

The simplification process aims to improve the tax by getting rid of anomalies such as this and reducing uncertainty and administration burdens for businesses.

The OTS recommendations

The 8 core recommendations made in the report are:

- Examine the current approach to the level and design of the VAT registration threshold, with a view to setting out a future direction of travel for the threshold, including consideration of the potential benefits of a smoothing mechanism

- Maintain a programme for further improving the clarity of its guidance and its responsiveness to requests for rulings in areas of uncertainty

- Consider ways of reducing the uncertainty and administrative costs for business relating to potential penalties when inaccuracies are voluntarily disclosed

- Undertake a comprehensive review of the reduced rate, zero-rate and exemption schedules, working with the support of the OTS

- Consider increasing the partial exemption de minimis limits in line with inflation and explore alternative ways of removing the need for businesses incurring insignificant amounts of input tax to carry out partial exemption calculations

- Consider further ways to simplify partial exemption calculations and to improve the process of making and agreeing special method applications

- Consider whether capital goods scheme categories other than for land and property are needed and review the land and property threshold

- Review the current requirements for record keeping and the audit trail for options to tax, and the extent to which this might be handled online

Changing the VAT threshold

The most significant issue identified in the report is the VAT registration threshold – the turnover level above which a business must enter the VAT system and charge VAT on its sales. At £85,000, the UK has the highest VAT threshold in the EU.

Whilst the report doesn’t make an outright recommendation, it does consider the consequences of what different changes to the threshold could mean. There are essentially three options, freeze the threshold, reduce it or raise it. Here we look at some of the options and the potential consequences discussed in the report:

Reduce the threshold

Suggestion: Reduce the threshold from £85,000 to £43,000.

Likely impact: This would impact between 400,000 and 600,000 businesses.

Advantages:

- Reduces the unregistered business population and competitive distortions

- Makes it harder for businesses seeking to evade VAT to remain undiscovered

- Raises between £1bn and £1.5bn a year

Disadvantages:

- Increases compliance costs for a large number of businesses

- Increases costs for HMRC in managing the additional registered businesses

Alternate suggestion: Reduce the threshold by a small amount.

Likely impact: A few thousand additional businesses would be required to register. This would increase the tax compliance costs of those businesses. This would only have limited impact on competitive distortions because only a small number of businesses would be affected relative to the overall UK business population, and the behavioural consequence might only be to shift the point at which bunching occurs.

Raise the threshold

Suggestion: Raise the threshold to £500,000.

Likely impact: This would potentially impact around 800,000 businesses. Of those, between 400,000 and 600,000 businesses might choose to deregister, while 200,000-400,000 might choose to remain voluntarily registered.

Advantages:

- Simplifies the tax obligations for businesses that choose to deregister

- Reduces VAT-related competitive distortions between registered and unregistered small businesses

- Reduces the administrative burden on those businesses

Disadvantages:

- Cuts the funds available for public services by between £3bn and £6bn a year

- Potential behavioural consequences. For example, the presence of many more unregistered businesses in the marketplace could well encourage some of them to operate in the hidden economy, reducing their compliance with – and payment of – other taxes

- Competitive distortions would also be shifted upwards

Alternate suggestion: Increase the threshold by a smaller amount, for example £2,000.

Likely impact: This would mean that approximately 12- 15,000 fewer businesses would be required to register.

Advantages:

- Administrative savings for those businesses

Disadvantages:

- Limited impact on competitive distortions.

- Tax revenue would be reduced by between £30-50 million in the first year, increasing over time

- The behavioural consequence might only be to shift the point where bunching occurs

Freeze the threshold

Suggestion: Maintain the existing threshold.

Likely impact: If the government had maintained the existing threshold in 2017/18 (rather than increasing it in line with inflation, as has become the norm), 4,000 extra businesses would potentially have been required to register in that year.

Advantages:

- This would have raised approximately £10m and would continue to raise more in future years if the freeze remains held

Disadvantages:

- Increases the administrative costs of businesses required to register

Industry reactions

Mike Cherry of the Federation of Small Businesses said:

“Any reduction of the VAT threshold against the current backdrop of unprecedented uncertainty and spiralling costs will have a hugely negative impact on growth within the small business community.

“Small business owners spend a huge number of hours a year complying with their VAT obligations – hours that should be spent running their firms.”

John O’Connell of the Taxpayers’ Alliance said:

“It is very encouraging to see calls to simplify the ludicrously complicated VAT system, and leaving the EU should be a catalyst for more of this.

“However, we should not accept stealth tax increases under the mask of simplification.”

IPSE’s Economic Advisor Tom Purvis said:

“In the short term, lowering the VAT threshold would lead to serious cash flow problems for many self-employed people. They would quickly be faced with the stark choice of either raising their prices – which would cause them to lose customers – or absorbing the cost themselves, which would do significant damage to their businesses.

“In the long term, it could actually discourage businesses from expanding over the threshold. Having a low threshold is also likely to create much more paperwork and administration for people at the lower end of the earnings scale.

“Overall, piling on the costs for the UK’s smallest businesses would not only cause the self-employed themselves serious problems; it would also do significant damage to the flexible labour market and, by extension, the wider economy.”

Frank Haskew, head of ICAEW Tax Faculty, said:

“VAT was introduced in 1973 as a ‘simple tax’. Since then it has become vastly more complicated to administer and is a significant burden that falls disproportionately on smaller businesses.

“Although the current VAT registration threshold of £85,000 is high, it is in practice a major simplification measure for smaller businesses. We believe it should be retained at its current level or consideration be given to increasing it further, perhaps with measures to ease businesses into VAT to avoid the ‘cliff edge’ effect.”

What do you think about the recommendations set out in the VAT review? What impact would changing the VAT threshold have on your business? Let us know in the comments below.

Alan Edmunds

13/09/2018 (10:55am)

Why not be totally radical and remove VAT altogether! Add 20% to Corporation tax instead. That would remove the cliff edge effect and the tax will only be paid on a value that a company can afford because they have made a profit. In Andrews situation that would put every one on a level playing field. Think of the staff and cost saving for the government as it will make all the VAT staff redundant.