£800,000 secured to facilitate MBO

The management buy-out of a tyre services company has been completed after Hilton-Baird Financial Solutions helped to bring the required funding to the table.

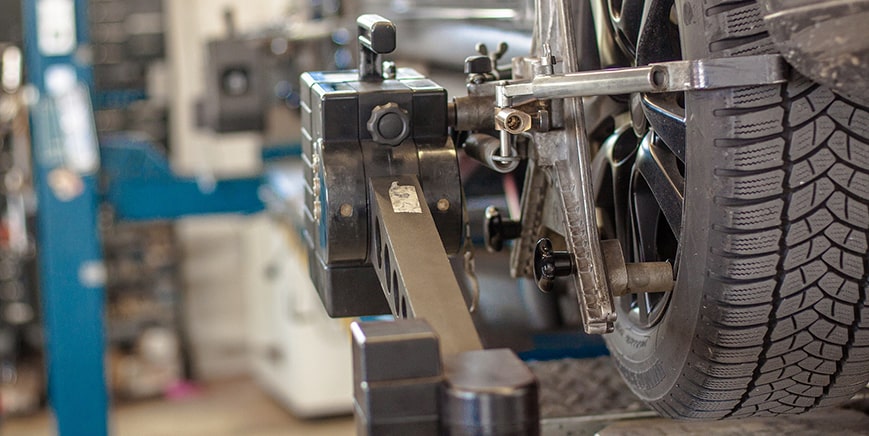

Established in 1995, Total Tyre & Support Services Ltd provides a range of tyre replacement and wheel repair services to businesses with fleets of vehicles.

With the company’s now prior owner looking to retire, a group of existing employees and partners were keen to purchase the business, but needed to raise additional funds to achieve this.

After contacting Hilton-Baird, our client gained access to our team’s extensive market knowledge and experience in facilitating transactions such as management buy-outs, and were introduced to suitable lenders who could facilitate the necessary structures and facilities.

Despite a couple of setbacks along the way, such as the vendor almost changing their minds and changing the price late in the process, which delayed the acquisition and meant additional funds were necessary, the result was £800,000 being raised through a combination of invoice finance and the Recovery Loan Scheme. This enabled the parties to complete the purchase and maintain an adequate level of working capital to support the new management team’s vision and growth plans.

“We were thoroughly impressed with the team at Hilton-Baird Financial Solutions throughout their entire approach and process,” said Andrew Simcock, one of the shareholders.

“From the way they handled our initial enquiry to the options they presented, it was clear we’d made the right decision to engage with Hilton-Baird, who were highly professional and clearly knowledgeable. Their support was evident at every stage and was invaluable to us. They were communicative, we felt supported throughout and they were clearly focused on delivering for us.

“We were delighted to have secured the funds necessary to complete the buy-out and continue to be excited for the future.”